North Carolina beat nine other states for a $1.29 billion battery plant that will soon rise in the central part of the Tar Heel State. But Toyota Motor North America’s investment toward its electric vehicle future there won’t be its last.

It may not even be the last in North Carolina.

Why? Because the company still has billions of dollars that it has committed to North American EV production, and the place where it will build its batteries is hundreds of miles from the nearest place in which to use them.

The plant, which Toyota says will eventually produce up to 1.2 million lithium ion battery packs annually for its lineup of North America-built hybrids, plug-in hybrids and eventually EVs, is expected to begin producing saleable battery packs in 2025. It will create about 1,750 jobs and be built on some portion of an 1,825-acre site — more than 2.85 square miles — near the town of Liberty, N.C., about 20 miles southeast of Greensboro.

For comparison, the SK Battery America plant in Commerce, Ga., which supplies lithium ion batteries for Volkswagen’s plant in Chattanooga, sits on just 263 acres, while Toyota’s potential site is half the size of the 3,600-acre mega campus Ford will build near Memphis, Tenn., which will include the company’s first vehicle assembly plant on an undeveloped site since 1969.

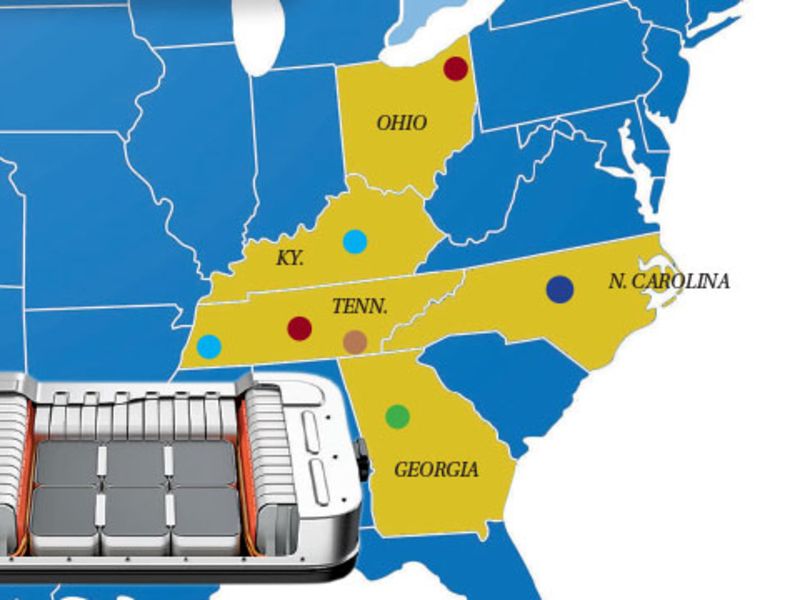

As a standalone Toyota battery plant in central North Carolina, it makes little logistical sense without the addition of an assembly plant, considering Toyota’s existing manufacturing footprint. Currently, the automaker’s nearest assembly plant, in Georgetown, Ky., is 450 miles northwest.

Chris Reynolds, chief administrative officer of Toyota Motor North America, told Automotive News that the company intends to use nearly the entire 1,825 acres for its plans, though he did not specify how much of the land would be occupied solely by the battery plant.

“Our intention is to take the vast majority of the property. Some relatively small portions may be excluded so they can be used for utilities, such as water and electrical, or because they do not currently qualify for conveyance for other discreet reasons,” he said. “Other small portions may be initially excluded but then subsequently conveyed.”

Reynolds said Toyota began its search for a site in March, and chose North Carolina because of its transportation infrastructure, business climate, education system and work force. The company’s only other facility in the state, its TRD subsidiary’s R&D site for racing and high-performance vehicles, is in Salisbury, a little more than 50 miles southwest of the new plant site.

State and local governments offered a $435 million incentive package to Toyota over a 20-year period to lure the development. The state said jobs at the plant are expected to pay an average of more than $62,000 a year.

In October, Toyota said it would invest $3.4 billion in the U.S. over the next nine years to develop and localize automotive battery production, including those for EVs that would be made locally instead of in Japan.

The U.S. investment is part of a previously announced $13.5 billion program globally by the Japanese automaker for battery development and production, which, unlike most other automakers, intends to keep battery production in-house instead of relying on large suppliers. Toyota has not yet laid out how it intends to spend the remaining $2.1 billion of its declared investment.

Stephanie Brinley, principal automotive analyst for the Americas with IHS Markit, said she couldn’t speculate on Toyota’s future plans for the North Carolina site beyond what the automaker had announced. However, she did note that battery packs for EVs are “very heavy, and automakers are unlikely to want to move them very far.”

This is not the first time Toyota has considered the Tar Heel State for a major investment. Former Toyota Motor North America CEO Jim Lentz told Automotive News in 2019 that Charlotte had been a finalist when the automaker was considering where it would move its headquarters, along with Atlanta. The company ultimately chose Plano, Texas, primarily because of a lack of available housing near Charlotte.

“The toughest part about that was housing — there just weren’t enough homes,” said Lentz, who retired in 2020. “I think our people would have been fighting over the same homes.”

Toyota Motor North America and its subsidiaries now employ about 4,350 workers in and around its Plano headquarters, a company spokesman said.