Shift Technologies Inc. reported record revenue and vehicle sales in the fourth quarter as it continued to dig itself out of an inventory hole brought on by the coronavirus pandemic.

The online used-vehicle retailer was more selective in inventory acquisition at the onset of the outbreak last spring. It also furloughed some of its reconditioning staff, relying more heavily on third parties to get its vehicles sale-ready.

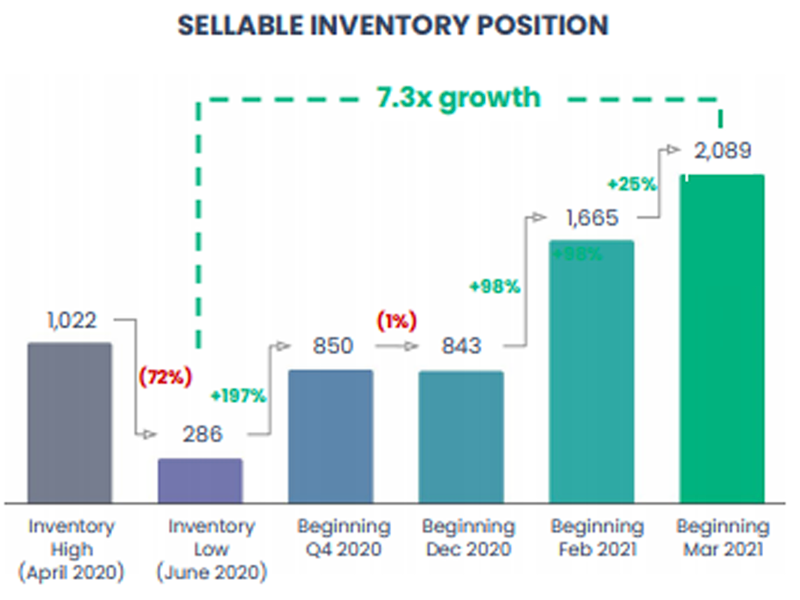

This led to an inventory gap when used-vehicle demand began to surge later in the spring and into the summer.

In the fourth quarter, Shift said, the company was able to “steadily and dramatically” reduce its use of third-party reconditioning, and by January, it was back at pre-COVID levels of having just 15 percent of its vehicles processed by outside parties.

In October, Shift was processing about 250 vehicles per week in-house, and it improved that number to more than 500 vehicles by the middle of the first quarter.

The company’s improvement in its sellable inventory position since hitting a low in June can be seen in this graph from its letter to shareholders:

In the fourth quarter, revenue jumped 168 percent to $73.4 million, on sales that soared 147 percent to 4,666 vehicles. Both were quarterly records.

Gross profit was $1.5 million, compared with a loss of $714,000 in the fourth quarter of 2019.

Shift reported a net loss of $4.5 million, compared with a loss of $20.5 million in the year-earlier quarter.

For the full year, Shift’s revenue climbed 18 percent to $195.7 million. Total vehicle sales rose 18 percent to 13,135.

Gross profit was $12.2 million, compared with a loss of $1.8 million in 2019.

The company’s net loss for the year was $59.1 million, compared with a loss of $80.5 million in 2019.

Shift became a publicly traded company in October following a reverse merger with Insurance Acquisition Corp., a special-purpose acquisition company, or SPAC.

That same month, it launched a hub in Seattle, giving it a presence along the West Cost from Canada to Mexico. In the fourth quarter, it launched four seller markets — meaning it acquires vehicles but does not actively sell them there — in Texas in Dallas, Fort Worth, San Antonio and Austin.

Shift’s shares rose 5.3 percent to close at $8.09 on Tuesday.