A searing five-day rally in the shares of Rivian Automotive Inc. has led the electric-vehicle startup to more than double in value since last-week’s trading debut, with its market capitalization now surpassing Volkswagen Group.

The stock jumped as much as 14 percent to $169.70 in New York on Tuesday, up 118 percent from the initial public offering price of $78. That brought the company’s market valuation to about $150 billion, making Rivian the largest U.S. company with zero revenue.

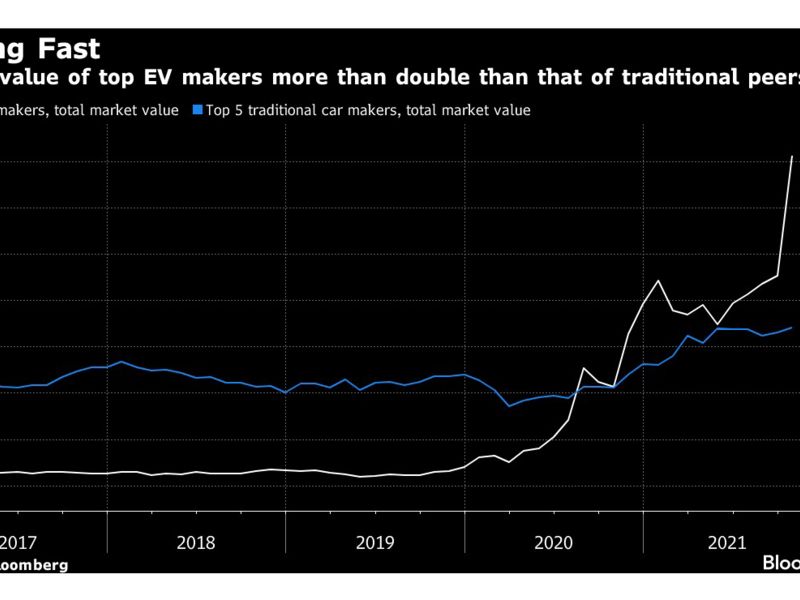

Rivian, which is backed by Amazon and Ford, overtook Volkswagen’s market capitalization of $138.9 billion, as investors eager to get into the EV sector now have another stock to invest in, apart from industry trailblazer Tesla Inc.

VW is Europe’s largest automaker with about 10 million vehicle deliveries per year, making it the global number two behind Toyota Motor Corp. Volkswagen generates about 250 billion euros ($300 billion) in revenue annually and targets around 15 billion euros in automotive clean net cash flow this year. The German industrial giant’s stable of brands includes luxury carmakers Porsche, Audi and Lamborghini as well Scania heavy trucks and Ducati motorbikes.

Meanwhile, Rivian, which is developing an electric pickup truck — R1T and an electric SUV — R1S, has started delivering some trucks in September, mostly to its own employees. However, it also estimates that annual production will hit 150,000 vehicles at its main facility by late 2023.

The rally since the IPO also makes Rivian’s debut week the year’s best, just ahead of Affirm Holdings Inc., which gained 117 percent during its first five sessions. This data excludes IPOs that raised less than $1 billion.

EV stocks of all stripes and colors have seen heightened interest from retail investors in recent weeks, with Rivian, Lucid and Tesla topping Fidelity’s retail trading platform’s list of most bought assets on Tuesday.

At one point during Tuesday’s trading, Rivian was worth more than almost 90 percent of S&P 500 companies, including stocks like Goldman Sachs Group Inc., Boeing Co., Citigroup Inc., Starbucks Corp. and Caterpillar Inc.