<!–*/ */ /*–>*/

| Pulling out all the stops in hot pursuit of used vehicles |

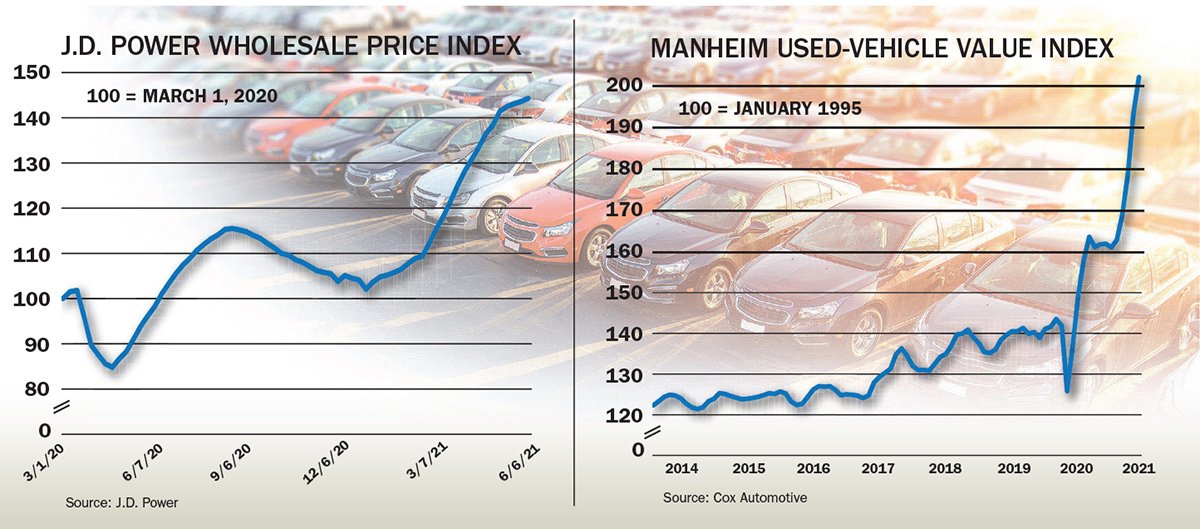

The high prices and short supplies of used cars are now the stuff of daily headlines, even beyond the automotive press.

We dig deep in a Page 1 story and in a special section in Monday’s issue. Here’s some of what we found:

■ Dealer Troy Duhon is rewarding his sales staff with bonuses as high as $400 for each used car they buy “off the street,” often using Facebook and other social media sites. “It’s the smartest thing I’ve done in 20 years,” he says.

■ Ohio dealer Joey Huang typically begins mining lease returns eight months before they expire. Now, “we’re working all the way back to 24 months,” he says.

■ Dealers are expanding their search geographically. Earlier this spring, Jason Pettigrew, a used-car manager at a Toyota dealership in Ohio, found himself bidding simultaneously on vehicles in Pittsburgh, Nashville and Orlando.

■ Wider searches are no guarantee of success given the stiff competition among buyers and the prices they’re willing to pay. “It’s pretty brutal,” said Marc Schumacher, a used-vehicle director in Maryland. “My one manager, he proxied 50 cars for an auction. … He got two of them.”

■ The tools dealers use to keep track of prices are quickly growing obsolete, forcing gut decisions. Ohio dealer Ken Ganley says the pricing guides he uses are three to six weeks behind the surges in values. “It’s almost impossible for those tools to keep up,” he said.

And we conclude with some tips from Cox Automotive executive and used-car guru Dale Pollak. He had seen it all in four decades in the car business, until the pandemic hit. Among his bits of advice: “What I counsel dealers to understand is what we’ve experienced the last six months is not the new normal.”

|

“Commercial [autonomous vehicle] deployments are limited to small operational domains, and in my opinion, that’s due in part to particular approaches that have not realized the power of AI and instead rely on complex and time-consuming methods. So it’s very costly to scale. I believe a radical new approach is necessary.” |

– RAQUEL URTASUN, FOUNDER OF SELF-DRIVING TECHNOLOGY COMPANY WAABI |

|

From “Startup Waabi promises ‘radical’ new approach to self-driving tech” |

|

Coming Monday in Automotive News:

Let’s call it the Elon Effect: Elon Musk’s disruptive car company has spurred many of the changes roiling the auto industry, particularly the rush to electric vehicles and direct online sales to consumers. Despite the Tesla founder’s sometimes erratic behavior, investors have made the company the most valuable in the industry, and it’s not even close. It’s no wonder the industry is seemingly taking its design and business cues from the onetime upstart. Automotive News looks at the ways Musk has forced the industry to adapt to change — and how that change isn’t great news for everyone.

You really need to be creative in the used-vehicle market these days: And you’ve got to be willing to spend some money, too. Buying customers out of their leases early? Check. Buying auction vehicles in poor condition and going above and beyond to fix them up? Check. Finding inventory in Canada? What? Check! Demanding that new-vehicle buyers have a trade-in before you’ll sell? Wow! Check! Automotive News takes a look at the lengths dealers are going to keep their used lots as full as they can in a high-demand, low-supply market.

|

Lithia buys 2 dealerships in L.A.: The group acquired its first Southern California BMW store and also added Center Acura, both in Sherman Oaks. The stores are expected to generate combined annual revenue of $185 million.

Cruise gets permit to deploy AVs in California: The state’s Public Utilities Commission authorized the General Motors-backed company’s request to operate prototype autonomous vehicles that could transport the public. Cruise won’t be allowed to charge for rides and is required to submit a passenger safety plan and quarterly reports about its AVs.

|

|

A selection from Shift and Daily Drive:

|

June 16, 1903: Henry Ford and 11 other investors — including brothers John and Horace Dodge — put up $28,000, and Ford Motor Co. was born. Henry Ford had failed with two other auto companies. He didn’t fail this time.