Five CEOs of publicly traded U.S. automotive companies realized more than $24 million in total compensation last year, according to the Automotive News/Equilar CEO Compensation Study.

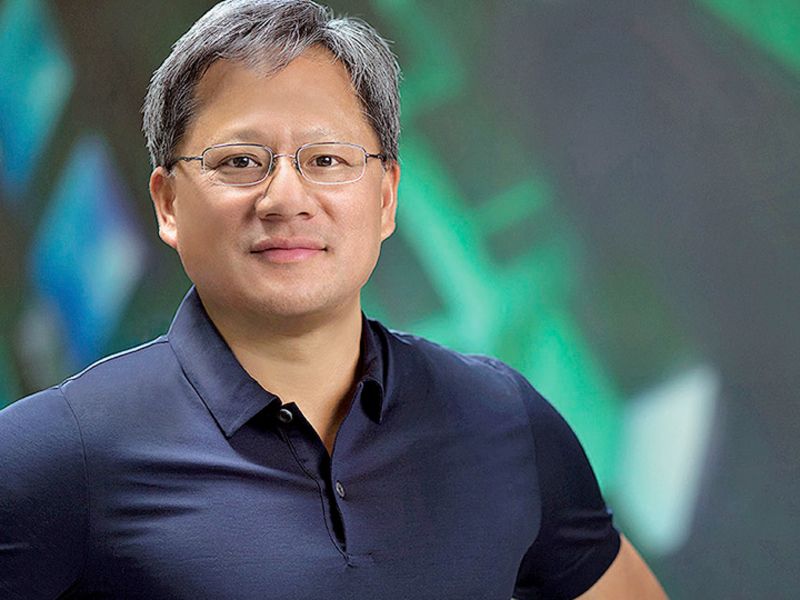

Jensen Huang of Nvidia was the highest-earning CEO by far. His compensation totaled $255 million, including a base salary of $1 million and $214.9 million in stock option gains.

General Motors’ Mary Barra, who received a $2 million salary, was No. 2 with $40.3 million in total compensation, followed by the CEOs of Illinois Tool Works, Eaton and Uber.

The study analyzed data for 48 companies, including automakers, suppliers and public retailers. Median compensation for the 48 CEOs was $6.4 million in 2020, compared with $7.1 million in 2019.

Among CEOs who have been in their positions for at least two years, median compensation increased 9 percent, said Charlie Pontrelli, senior project manager at Equilar.

The study calculates total compensation as the sum of the executive’s base salary, cash bonus payouts, gains from stock option exercises, gains from the vesting of stock awards and other compensation, which typically includes benefits and perquisites, Equilar said. The data is pulled from summary compensation tables in each company’s annual proxy statement.

The total compensation in Equilar’s report differs from company-reported figures that include the grant date value of equity awards. Equilar’s survey includes the realized value of options exercised and stock vested during the fiscal year. In most cases, the realized value of equity is attributable to awards granted in prior years.

Last year, amid the coronavirus pandemic, “we had a giant stock market crash and then a rally,” Pontrelli said. “A lot of the options may have been exercised later in the year when the stock prices were very high. These were options that were granted in prior years.”

The majority of Huang’s compensation came from exercising expiring stock options granted in 2010 and 2011, according to a company spokesperson. He also received additional shares from vesting of restricted stock units granted between 2016 and 2019 worth $36 million.

The spokesperson said the stock value reflects growth in the company’s share price, which has increased about 50-fold over the past 10 years.

Barra’s 2020 earnings included $33.9 million in stock option and stock award gains.

E. Scott Santi of Illinois Tool Works, which makes engineered fasteners and other components, was No. 3 at $31.6 million. Craig Arnold of engine supplier Eaton was No. 4 at $24.4 million, and Dara Khosrowshahi of Uber was No. 5 at $24.03 million.

Tesla CEO Elon Musk was on the list, but he didn’t make anything in 2020 using Equilar’s methodology. Musk forfeits his salary and didn’t exercise any options or vest stock during the year. In 2018, Tesla investors approved a pay package of stock options that vest in increments as goals are met.

“Portions of that option grant have vested,” Pontrelli said. “But he has not yet exercised any of them.”

In 2019, Musk made $30.5 million.

Three Tesla executives were the highest-paid non-CEOs in Equilar’s analysis.

Jerome Guillen, who was president of Tesla’s automotive division before changing jobs and then leaving the company this year, made $32.1 million in 2020, including $29.8 million in stock option gains. Guillen made $3.4 million in 2019, according to the survey.

CFO Zachary Kirkhorn and Andrew Baglino, Tesla’s senior vice president for powertrain and energy engineering, also received eight-figure compensation.

Aside from Huang at Nvidia, the most significant compensation gains were among CEOs who lead used-vehicle and remarketing companies.

Vroom’s Paul Hennessy made $5 million, up from $393,077 in 2019. He earned $4.6 million in stock awards last year as the company went public. Jeffrey Williams of America’s Car-Mart made $3.2 million, up 77 percent. Jim Hallett of KAR made $12.9 million, up 74 percent. Hallett exercised $5.5 million in stock options after exercising none in 2019.

Michael Martinez contributed to this report.