The gap between how quickly automakers replace their annual volume with new models is reaching its widest point in recent auto industry history.

Honda and Toyota lead in model replacement rates while Stellantis and General Motors trail the pack, according to a study of U.S. product pipelines in the latest annual study “Car Wars.”

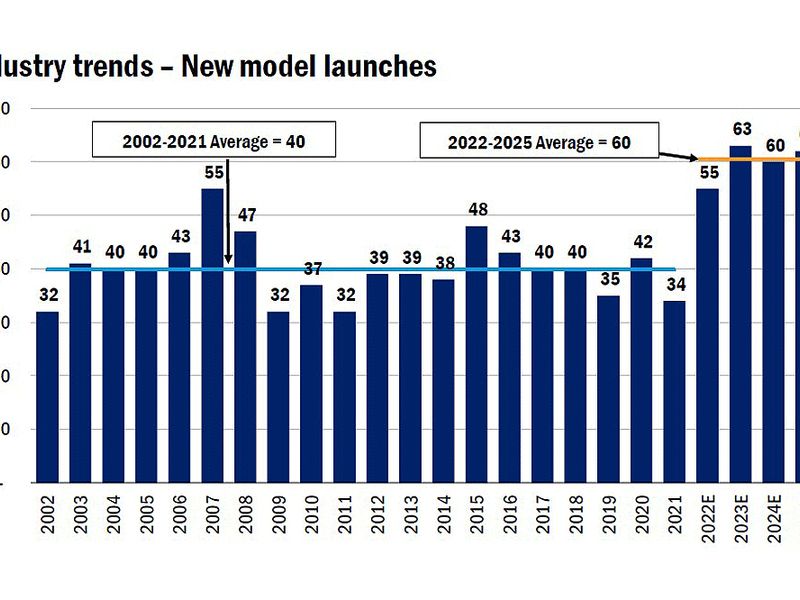

At the same time, the arrival of new vehicle models across the industry is ramping up to its highest level of activity in at least two decades, John Murphy, senior auto analyst at Bank of America Merrill Lynch, which publishes the annual Car Wars study, said Thursday.

Murphy said automakers will launch roughly 240 new models over the next four model years, averaging 60 a year. Over the past 20 years, new launches have averaged just 40 a year.

That should be good news for retailers, according to the study: Due to a mix of competitive pressures between rival automakers, the entry of newer manufacturers into the business, the expansion of product portfolios and the cancellation of some older products, the industry’s average showroom age will remain relatively fresh over the next four years, according to the study.

Between model years 2002 and 2021, the industry replaced about 16 percent of its volume each year with new models. Over the next four model years, the annual replacement rate of industry volume will average about 21 percent of the total, according to the study.

The average product age for the next three years will rise slightly, the study predicted. But then it will drop in model year 2025, averaging around 3.1 years.

But the study also highlights what appears to be a growing disparity between the rate of vehicle replacements among automakers.

The difference in so-called “replacement rates” has grown into a gap that is three times what it has been in recent years. Murphy said that reflects a growing shift, particularly by GM, to focus on new powertrain strategies rather than new models. More than 60 percent of new models coming in the next four years will have an alternative powertrain.

“Over the next three years, GM is almost exclusively launching electric vehicles,” Murphy said on a conference call today. “They’re not playing around.”

But he said GM’s focus on EVs could hurt its market share in the near term as pricey electric vehicles translate to lower volumes.

“We’re going to see a very significant market share shift over the next four years driven by very distinct differences in powertrain strategies,” Murphy said.

Automakers are also aggressively pursuing the crossover segment, particularly at the premium price point. This will likely pressure that segment’s profitability in the next few years.

Crossovers will account for 52 percent of new model launches over the next four years, with light trucks accounting for 20 percent, the study forecast.

Honda and Toyota are best positioned in traditional replacement rates. However, GM, and to a lesser extent VW, are well-positioned in powertrain investment and EV introductions.

Ford and GM lag the industry replacement rate, but Ford is slightly ahead on a reaccelerated product cadence.

The Japanese OEMs have a volatile product cadence, and with differentiated segment focus, compared with the rest of the industry. Honda and Toyota lead the industry in their anticipated rates of model replacement while Nissan lags.

European automakers as a group, and the Koreans, are lagging the industry average on model replacement, according to the study.