<!–*/ */ /*–>*/

| Lessons learned, forgotten from ‘3-11’ |

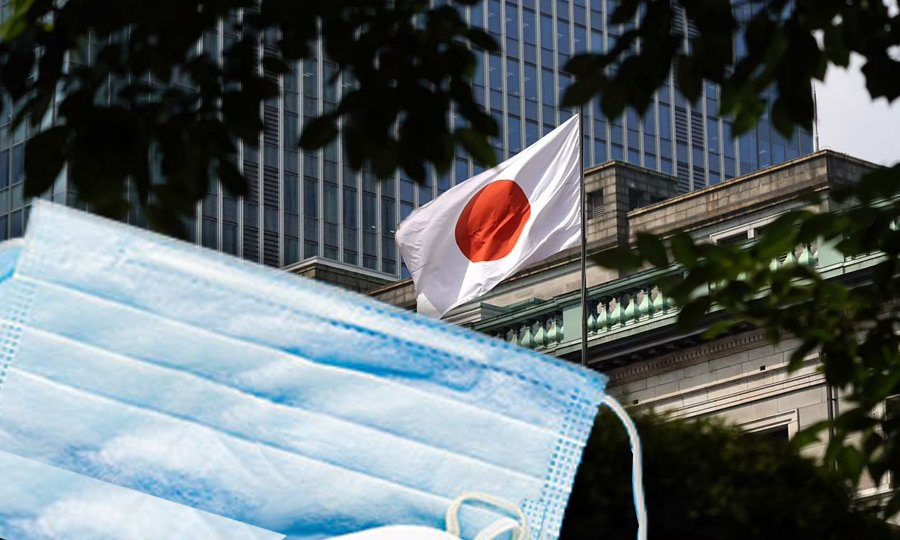

The date is seared in the minds of the Japanese, much like Nov. 22 and Sept. 11 are for Americans. March 11, this Thursday, marks the 10-year anniversary of the earthquake and tsunami that devastated much of Japan.

And, in a bizarre coincidence, that same date in 2020 was for Americans an unforgettable marker in the life of the coronavirus pandemic.

That evening alone, President Donald Trump banned travel from Europe, the NBA canceled its season and actor Tom Hanks revealed he had COVID-19.

The day was “the pivot point on which weeks of winter unease about the looming novel coronavirus turned in a matter of hours into a sudden, wrenching, nation-altering halt to daily life and routine,” Wired magazine wrote.

Both events, nine years apart, had dramatic impacts on the auto industry.

And we explore them in Monday’s issue. Namely:

■ The lessons that the Japanese industry learned from the 2011 disaster. And those that were ignored.

■ How the aftermath of the quake demonstrated to Subaru dealers that they could successfully function with a much lower supply of cars than had been considered the norm. They’ve operated that way since.

■ How Ford responded in 2011 as 55 formerly stable parts makers suddenly teetered. “That event really, for us, was kind of an epiphany in terms of how we thought about risk in purchasing,” chief operations officer Hau Thai-Tang said.

■ How Toyota in North America dealt with the effects of the coronavirus by using the playbook developed after the 2011 disaster.

■ How many of the lessons from 2011 were forgotten when it came to dealing with the shortage of a key component triggered by the pandemic.

That part? Microchips. A missing link in supply chains after the earthquake … and again in 2021.

|

“The buy-sell market is especially strong right now and we knew that joining efforts with a larger group was the best way to ensure that our dealerships will continue to be market leaders in today’s fast-changing auto retail environment.” |

– FINK AUTOMOTIVE GROUP PRESIDENT SCOTT FINK |

|

Coming Monday in Automotive News:

Supply chain fragility still on display: Ten years ago this week a massive earthquake and tsunami in Japan killed nearly 20,000 people, spawned a nuclear crisis and hammered global auto production for much of the year. The industry worked to shore up its supply chain to avoid a repeat of the 2011 crisis, but another temblor on Feb. 13 has shown just how short those efforts have fallen. The recent quake shattered supply chains and forced Japanese automakers to suspend production at plants across the country. Automotive News looks at how the industry thought it was better prepared, and how it was only half right.

Is GM undergoing a metamorphosis? Will General Motors finally be dubbed a “tech company?” Last month, CEO Mary Barra said between 2025 and 2030, GM will be viewed as a technology company, a title for which many automakers have long clamored. GM has broadened its technology and services portfolio to include auto insurance, electric delivery vans, a safety brand, driver-assist technology and more. The automaker’s expansion to adjacent services is part of a goal to stretch what’s typically a one-time transaction into a larger profit net over the lifetime of the vehicle. Automotive News investigates what GM’s evolution could mean long term.

Weekend headlines:

What to expect from Stellantis in 2021: CEO Carlos Tavares says the combined Fiat Chrysler-PSA group will not be labeled as only a “legacy car company.”

|

Mercedes miss: The automaker falls short of fuel economy targets for the U.S. and China.

Five Star buys 5: The Atlanta-based group purchased its first dealerships in the Midwest, acquiring five locations in Lafayette, Ind.

<!–*/ */ /*–>*/

|

|

|---|

|

|

A selection from Shift and Daily Drive:

|

March 11, 2011: Japan was hammered by an unprecedented earthquake-tsunami-nuclear meltdown triple disaster. The 9.0-magnitude quake that struck off the country’s northeast Pacific coast was the biggest ever recorded in the seismically active country. It unleashed a towering tsunami that swept hundreds of miles of the country’s coast, flooding the Fukushima Daiichi Nuclear Power Plant and triggering meltdowns at three of its reactors. Beside killing nearly 20,000 people and completely obliterating entire towns in a swath along the shoreline, the catastrophe hammered global auto production for much of that year. Japanese automakers alone lost more than 1.5 million units of output at the peak of the crisis. Through heroic efforts, some companies — such as Nissan and Mitsubishi — managed to recoup that loss by the following year. But others, including Toyota, Honda, Mazda and Subaru, still couldn’t catch up. All told, the 2011 disaster cost Japanese automakers more than $5.60 billion.