Hindenburg Research, the firm that took aim at Nikola Corp. last year, is now turning its sights on electric pickup maker Lordstown Motors Corp.

“Lordstown is an electric vehicle SPAC with no revenue and no sellable product, which we believe has misled investors on both its demand and production capabilities,” Hindenburg said in a report on Friday.

“Despite claims that Lordstown will be producing vehicles by September, a former employee explained how the company is experiencing delays and making ‘drastic’ design modifications, putting them an estimated 3-4 years away from production,” Hindenburg said.

The truckmaker is one of a slew of electric-vehicle startups that have gone public through mergers with special purpose acquisition companies. A number have come under close scrutiny, including Velodyne Lidar Inc., whose founder left amid a fight with its board.

Hindenburg further said that despite claims that battery packs would be made in-house, it had been told by former employees that “the equipment is months away from arriving, let alone being put into a production environment.” For now, the packs are being assembled by hand, the firm said.

The employees also said “that the company has completed none of its needed testing or validation, including cold weather testing, durability testing, and Federal Motor Vehicle Safety Standards testing required by the NHTSA,” according to Hindenburg.

Lordstown said in January it had received more than 100,000 non-binding production reservations from commercial fleets for its EV truck.

“Our conversations with former employees, business partners and an extensive document review show that the company’s orders are largely fictitious and used as a prop to raise capital and confer legitimacy,” Hindenburg said.

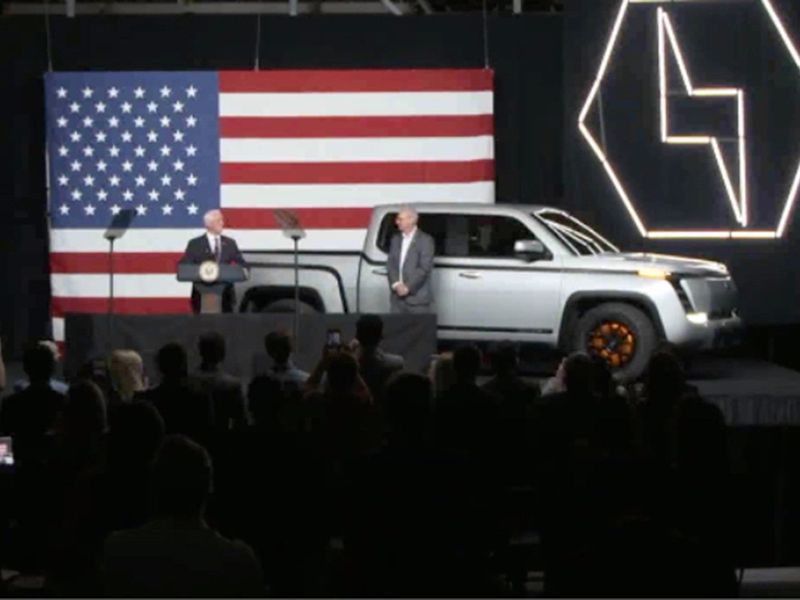

Steve Burns, CEO of the Lordstown, Ohio electric truck manufacturer, said in a text message to Bloomberg that “we always stated that pre-orders were non-binding. That is what pre-orders are.”

While Burns denied the allegations made in the report, the short-seller’s missive set the stage for Lordstown having to use its March 17 earnings report, its first as a public company, to defend itself. Lordstown shares fell 17 percent to close at $14.78 Friday in New York.

Hindenburg said that a $735 million order touted by Lordstown was made by E Squared Energy, a Texas company that doesn’t yet operate a fleet.

The report also said that Lordstown, which bought a small-car plant closed in 2019 by General Motors, has used a consulting firm to help generate pre-orders for its electric pickups but that since the sales are non-binding, claims of future revenue will be difficult to convert to real cash flow.

Burns acknowledged that Lordstown hired consulting firm Climb2Glory and said it wasn’t done to create a false impression of sales, but to determine how many customers it could realistically get for its truck. Lordstown also hired the EY consulting firm to study potential sales volume, he said.

“Demand will not be our problem,” Burns said. “We will have more demand than we can possibly build.”

In response to the assertion made in the report that production is three to four years off, Burns said: “We are on track for betas this month and start of production in September. Any statement to the contrary is a lie.”

Last September, the short-seller accused Nikola of fraud, leading to the resignation of its founder, Trevor Milton. Nikola had publicly rejected all accusations.

In February, however, Nikola disclosed that the company and Milton had made several statements that were partially or completely inaccurate, after an internal review.

Following Hindenburg’s accusations, GM and Nikola in November announced a reworked agreement on a fuel cell partnership, allowing the automaker to back out of taking a proposed equity stake in the startup.

Reuters, Bloomberg and Automotive News contributed to this report.