Electrified vehicles will account for more than half of light vehicles sold across the globe by 2026, largely driven by sales in Europe and China, according to a new forecast from Boston Consulting Group.

The projection is an ambitious update to the group’s forecast last year that electrified vehicles would account for only a third of sales by 2025.

And BCG said in the report released Tuesday that zero-emission vehicles will replace internal combustion engines “as the dominant powertrain” for new light-vehicle sales globally just after 2035.

The report examined the reasons why electric vehicles can’t come fast enough amid billions of automaker R&D dollars being invested in them.

BCG said it sees the transition to EVs playing out in three phases: incentive-driven and early adopter-driven electrification; ownership cost-driven electrification; and supply-driven electrification.

First, BCG anticipates that by 2023, there will be more than 300 battery-electric and plug-in hybrid vehicles brought to market. Currently, Automotive News estimates there are just under 100 battery-electric vehicles and plug-in hybrids in development through 2024.

It’s expected that plug-in, full and mild hybrids will command 25 percent of the global light-vehicle market in 2023, BCG said.

Second, BCG projects that by 2030, battery pack costs will have dropped dramatically and that the shift to EVs will be most notable in Europe and China.

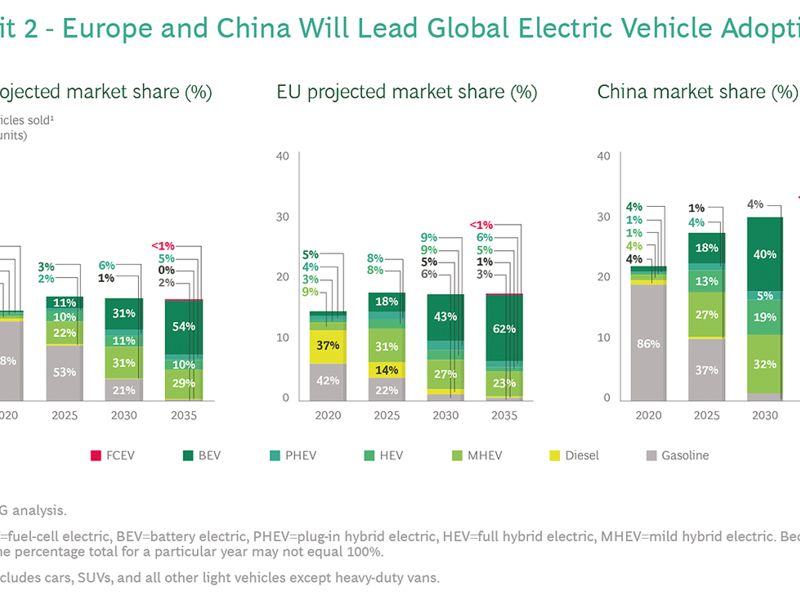

BCG said 91 percent of light vehicles sold in the U.S. in 2020 were powered by only gasoline or diesel engines, while it projects that number will be just 2 percent by 2035.

In Europe, 79 percent of light vehicles sold last year were powered by only gasoline or diesel engines, and BCG expects that will be just 4 percent by 2035.

Light vehicles powered only by gasoline or diesel engines accounted for 90 percent of units sold in China in 2020, but BCG said that number will be essentially zero by 2035.

Lastly, BCG said supply, rather than total cost of ownership, will drive EV adoption.

“We expect that market leadership will be divided among a more even mix of new EV-only players and incumbent OEMs, and be determined by how well the companies manage their portfolios across regions and scale up their production, distribution, and services,” the report said.

Despite the positive outlook, there remain major challenges for EV penetration across the globe, chief among them slower adoption in regions outside Europe, China and the U.S. There are also concerns over meeting emissions targets as well as calls for more aggressive policymaker action on widespread barriers to EVs, such as charging infrastructure and grid preparedness.

“The divergent powertrain trajectories will create complications for OEMs, which have spent decades trying to build truly global platforms and optimized supply chains,” BCG said. For example, market dynamics such as in Brazil and India will result in slower adoption of EVs there.

BCG estimates that by 2030, an additional $1,100 in investment in grid updates will be needed to support each BEV on the road, or $25 billion in investment if BCG sales projections come to fruition.

BCG said the role of the supply chain and dealers cannot be underestimated in preparing for future EV demand.

Despite these challenges, the consultancy remains hopeful: “We believe each of these obstacles can be surmounted,” the report said.

“Capital is increasingly available, the commitment among policymakers and industry leaders is strong, and the technology is evolving quickly enough to keep the EV transition from derailing in the long run.”