Self-driving tech company Aurora is firming up plans for manufacturing lidar sensors at scale.

The company on Friday said it agreed to acquire lidar-on-chip startup OURS Technology, a move intended to pave the way for producing large quantities of the sensors, which allow vehicles to perceive their environment and detect obstacles in their path.

Aurora, in a statement, said the planned acquisition will help it move past basic development of its lidar technology and toward an automotive-grade commercial product. Terms of the deal were not disclosed. Aurora said it expects to close on the acquisition in a matter of weeks.

This won’t be Aurora’s first purchase of a lidar startup. In May 2019, the company purchased Blackmore, a Montana lidar company that helped pioneer a particular lidar technology called frequency modulated continuous wave.

The FMCW lidar enabled Aurora’s vehicles to perceive objects at distances of more than 300 meters, a critical element of the company’s plans to deploy self-driving trucks on interstates, where highway speeds demand the capability of longer-range sensing.

Refining the underlying technology was one component of that plan. Producing at scale is a second component that some industry experts say is particularly vexing for FMCW lidar.

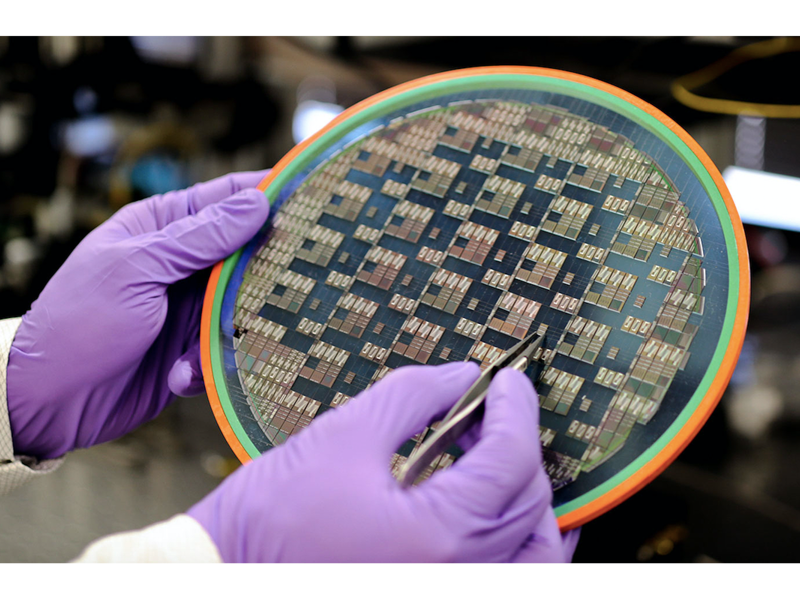

Aurora says the OURS Technology acquisition will allow it to rid lidar of spinning parts and move to true solid-state lidar units. Further, it will allow the company to produce them in smaller sizes more easily adapted to a variety of vehicular constraints. Produced earlier this year, OURS’ fourth-generation lidar sensor was one-tenth the size of its original.

Foremost, the ability to widely produce the lidar, which Aurora has branded as FirstLight, will bring down the cost of FMCW, which can be more expensive than traditional amplitude-modulated sensors.

“With its significantly reduced cost structure, improved performance through instant velocity readings, and small form factor allowing for easier integration … FMCW lidar could significantly disrupt lidar incumbents, such as Velodyne, which utilize large, bulky, spinning applications with significant cost and maintenance disadvantages,” Pitchbook analyst Asad Hussain said.

The OURS acquisition would be the latest in a flurry of activity from Aurora, which rolled out a partnership with truck manufacturer PACCAR in January and a robotaxi engineering partnership with Toyota Motor Corp. and its affiliate supplier Denso Corp. earlier this month. Those deals come on top of Aurora’s acquisition of Uber’s Advanced Technology Group, which was announced in December.

For years, Aurora has emphasized that it wanted to build a self-driving system versatile enough to be deployed on a wide range of vehicles, from delivery bots to Class 8 trucks. Though there are no timelines for commercial deployments, those plans are gathering momentum.

“This acquisition, similar to our other early foundational investments, enables us to move at a speed that others cannot,” an Aurora spokesperson said in a written statement.