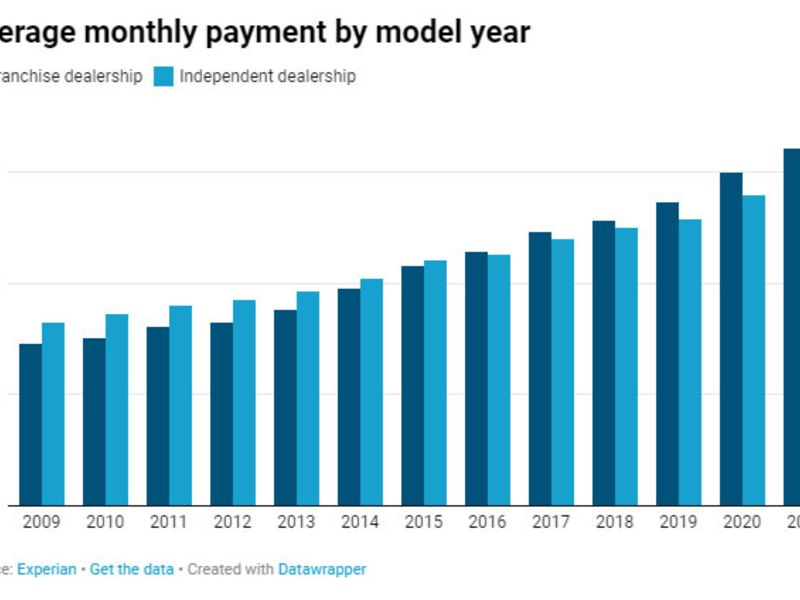

A buyer returning to the used-vehicle market after three or four years would need to go back to the 2014 model year to find the kind of $400 monthly payments their previous purchase might have carried, according to Experian.

And if the owner were financing at an independent dealership, they’d have to settle for the 2013 model year to keep the bill at $400, Experian concluded following an analysis of third-quarter auto sales trends released Dec. 2.

Used-vehicle loans rose 20 percent to $25,909 in the third quarter compared with the same period last year, and the average monthly payment rose $64, or 16 percent, to $465. The average amount financed on new vehicles rose 8.5 percent to $37,646, and the average monthly loan payment rose 8.8 percent to $615.

Experian said later model years drove the increase in used-vehicle payments, though Melinda Zabritski, Experian’s senior director of automotive financial solutions, said older vehicles gained value as well.

“Since most consumers shop based on monthly payments, there might be a bit of sticker shock for some, particularly those that have been out of the market for a few years,” Zabritski said in a statement.

“That said, consumers can still find comparable monthly payments — they may just have to go back a few model years in order to find it. It’s important for dealers to level-set expectations for consumers reentering the market. These kinds of data points can help inform decision making as lenders and dealers look to help consumers secure the vehicle that best fits their budget and needs.”

If a franchise dealer’s customer needs $300 monthly payments, Experian’s data indicates they’d have to shop for something in the 2009 or possibly 2010 model years, Zabritski said in a Dec. 2 webinar. Financing the average 2009 model required $290 a month, and a loan on a 2010 vehicle averaged $302 monthly payments, according to Experian.

None of the model years between 2000 and 2021 averaged that low of a monthly payment at an independent dealer, according to Experian.

However, more than 88 percent of used-vehicle financing involved vehicles in the “current plus eight years” range preferred by lenders, Zabritski said. By the 2013 model year, the amount of financed vehicles falls below 50 percent. For sales of even older models, “the financing sharply drops off,” she said.

This raises a potential affordability consideration if buyers need to purchase older models to fit a payment into their budget but lenders aren’t willing to finance vehicles that old, according to Zabritski.

Some lenders will exceed this nine-year range, “but it tends to be in the prime space,” Zabritski told Automotive News. She predicted the industry would be watching the issue of affordability for subprime borrowers in the future.

Vehicles from the 2017 model year or newer all carried higher monthly payments on average than the $465 seen across all used vehicles during the quarter. By the 2018 model year, customers were paying at least $500 a month on average for used vehicles at both independent and franchised dealerships.

It’s not just the hot vehicle market driving up later-model averages, however.

Zabritski said the changing vehicle mix also has served to push up the average monthly payment. Later model years have seen higher sales of SUVs and lower demand for cars, which tend to cost less.

“It’s just weighted toward bigger vehicles,” she said.

Vehicle price increases also kept third-quarter loan-to-value ratios on used models down from prior years, Experian said.

Zabritski said during the webinar the elevated adjusted clean retail prices on used vehicles meant customers could pay off their old loans and roll more equity into new ones.

Six of the 10 most popular financed used vehicles were worth more than their original sticker prices during the third quarter of 2021, and the average adjusted clean retail price rose $6,339, or 31 percent, to $26,591 compared with the third quarter of 2020.

The average used-vehicle transaction in the third quarter carried a loan representing 111 percent of the vehicle’s adjusted clean retail price, down more than 10 percentage points from the loan-to-value ratios seen in 2019 and 2020.