Dealerships and lenders can use technology to hasten and augment the stip process, a startup working with some of the major automotive finance companies has demonstrated.

Informed.IQ goes beyond traditional submission methods for stips — income stipulations — such as uploading images to a portal, linking bank accounts or physically bringing documents to a dealer, CEO Justin Wickett said. Under the old system, a customer might be able to upload a picture of a pay stub, but they wouldn’t immediately know whether the information is enough to confirm the loan, he said.

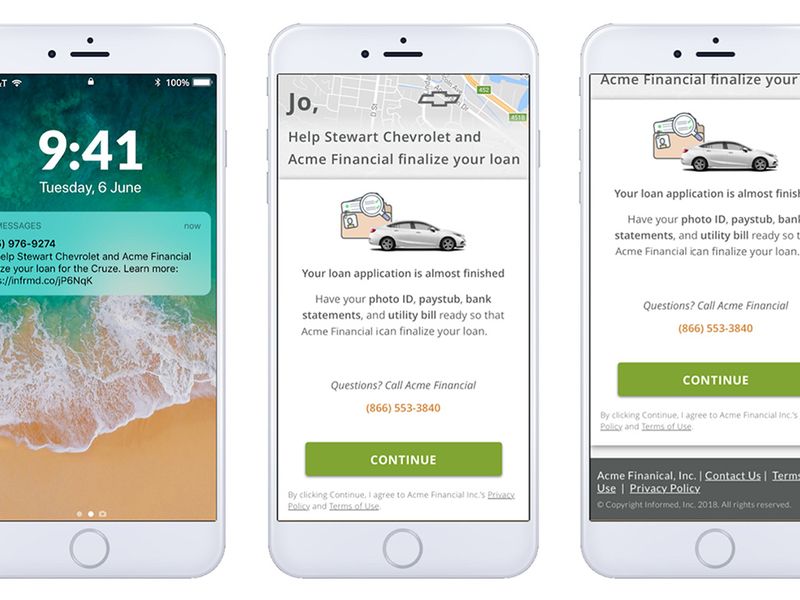

But Informed can automate “over 95 percent of situations” with artificial intelligence reviewing documentation images and confirming information such as income or address immediately, Wickett said. The Informed system can text the customer a link to the submission portal, which permits the buyer to submit the stips from home.

Dealers can use such document analysis to qualify a buyer before the consumer visits the dealership and produce “stip-free deals,” according to Wickett. The technology might also minimize a dealer’s time in limbo that’s created when they allow a customer to take home a vehicle while awaiting the lender’s decision to buy the deal. Wickett said it can often take 14 days before a lender provides financing, but the automated process has allowed some of the nation’s largest indirect lenders to fund dealers “same day.”

Informed received a patent on its process in July 2020 and began piloting it at one of the country’s largest buy-here-pay-here dealership groups. The startup expanded the tech nationally in September this year.

A recent Point Predictive survey of major prime and subprime lenders found 23 out of 27 creditors attach stipulations to at least 20 percent of loan applications. Nine of the subprime lenders polled required stips 100 percent of the time.

Informed’s technology goes beyond image recognition and confirmation of information within the document. Wickett said the software can compare buyer data against a database of 25 million records, which allows Informed to check factors such as a stub’s resemblance to others from the employer and the buyer’s income in relation to others in their profession.

Wickett said the AI can examine variables such as overtime and commissions in line with lenders’ individual policies. According to Wickett, 30 percent of vehicle buyers understate their income, and running their financials through the computer could reveal the consumer deserves a more favorable rate.

“That’s good for the dealers, too,” Wickett said.

The company handles 100,000 applications a month, “predominantly auto,” and has worked with companies including Ally, DriveTime and Westlake Financial, Wickett said. He said Informed had historically focused on lenders, who wish to free up staff, but has also worked with retailers, including CarMax and large dealership groups.