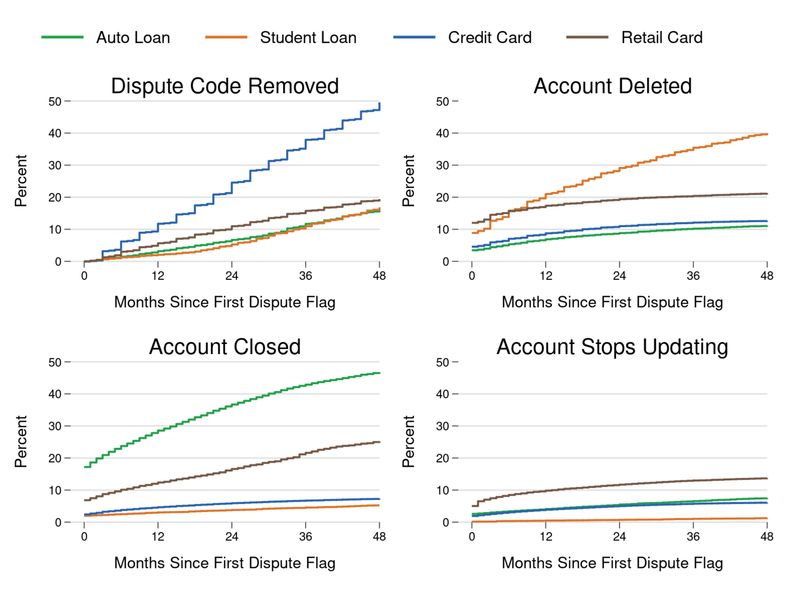

About 17 percent of consumer credit disputes over auto loans result in the loans being closed immediately, with another 4 percent addressed three months after the customer alleged an error, according to new Consumer Financial Protection Bureau research. More than 40 percent of auto loans with a dispute flag were closed within four years, the agency said.

Auto loans were far more likely than other forms of debt to be closed when a customer raises an objection, though the dispute flag will remain, the CFPB found. The other loan types studied were more likely to be resolved with different methods, such as the dispute code’s removal, the account’s deletion or a lack of further account updates, according to the CFPB.

“Some of the high rate of closed auto loan accounts is due to the relatively shorter term of auto loans, as many of these accounts were paid off according to the normal payment schedule,” the agency wrote. “Other closed auto loans go directly from having a substantial balance to being marked paid in full, without evidence of a lump sum payment being made.”

Consumers filed a credit dispute in about 0.75 percent of auto loans between 2012 and 2019, according to the CFPB. That number could potentially grow — the agency noted credit reporting complaints in general more than doubled in 2020.

“Because of the importance of credit reporting to the consumer finance system, the accuracy of credit reports is a perennial policy concern,” the CFPB wrote in its report introduction. “Studies have found that a substantial minority of consumers have errors on their credit reports with the three nationwide consumer reporting agencies (CRAs), including errors that can meaningfully affect consumers’ credit scores.”

The average auto loan had been on the books for more than two years before a dispute arose, according to the CFPB. Just 39 percent of those loans had been reported delinquent first.

The bureau noted its previous research showed actual payment information can be inconsistent and that some cases “were incorrectly marked as still open but were revised to show as closed,” the agency wrote.

An example of this arose in federal court just two days after the agency announced its research.

A Pennsylvania woman sued GM Financial and TransUnion in U.S. District Court on Nov. 2, alleging both failed to reflect her settling a delinquent $10,124.71 car loan from the captive finance company. Elizabeth Richardson said GM Financial ultimately charged off the loan and agreed to settle it with a $3,000 payment on her part. However, she alleged, her credit report continued to show a $7,124 debt, reflecting a normal payment rather than a settlement amount.

Richardson filed a Fair Credit Reporting Act dispute. Equifax and Experian updated their records to delete the account or mark it as paid. But GM Financial and TransUnion failed to address the issue for that bureau within 30 days, she said, suing GM Financial for one alleged violation of the act and TransUnion for two.

Both GM Financial and TransUnion declined to comment on pending litigation, per company policy.

The CFPB found credit scores increase slightly after disputes, with the average auto borrower having a 596 score and then gaining 6.3 points.

Customers raising disputes on their auto loans were more likely to be younger, have deep subprime credit scores at the time of the loan and live in majority Black census tracts. The CFPB noted the proportion of auto credit disputers falling into the subprime category was about double that of the “non-disputers,” and the proportion of people in majority-Black areas who filed auto credit disputes was more than three times the percentage in majority-white areas.