Penske Automotive Group Inc. has been largely quiet in this year’s dealership acquisition spree by U.S. public auto retailers, but it does see a sizable opportunity to grow — in Japan, where it just bought the remaining stake in a group of luxury stores.

The Bloomfield Hills, Mich., auto retailer took full ownership of the Nicole Group in October, nearly six years after investing in the Tokyo-area stores.

“We said we would go in with 49 percent, help build it, which we did, and then we’d have the opportunity to buy the balance after a certain period of time,” Penske CEO Roger Penske told Automotive News. “We certainly exercised that at very reasonable pricing here in the last few weeks.”

Penske didn’t disclose what he paid for the 51 percent stake, but his description contrasts with the high dealership prices he said he’s seeing in the U.S., where dealership buy-sells and consolidation have accelerated. Many of Penske’s auto retail competitors have announced mega dealership acquisitions this year.

Penske highlighted his company’s diversified model that includes not only automotive retail but a commercial truck business and income generated from its investment in Penske Transportation Solutions, a transportation and logistics company. Penske Automotive also has been focused on trimming debt and has repurchased shares this year.

“When we start to balance stock buyback and return to the shareholder versus some of the multiples that are out there on these bigger deals, we felt that we would sit on the sidelines,” he said. “We see them. There’s no one [who] says that we cannot participate as we go forward.”The murky sightlines around the future of auto retail provide another reason to hold off, he said.

“I’m not sure what the marketplace is going to look like 12 months from now with [the] supply chain potentially being back in order, what kind of government regulations are going to take place, what’s going to happen with electrification,” Penske said. “There’s too many question marks right now, at least for Penske, to make one of these big acquisitions.”

But Penske is in no way backing off acquisitions. He intends in the near term to grow the company by about 10 percent a year — or roughly $2 billion — in annual revenue, via purchases and same-store growth.

In the first nine months of 2021, Penske acquired a Mercedes-Benz dealership in Pine-ville, N.C., and Kansas City Freightliner, which are expected to generate $600 million in annual revenue combined. The company this year opened a Porsche dealership in Virginia, and it has two open-point franchised dealerships in the U.S. and one in the United Kingdom under construction, all of which are expected to open next year.

Penske also is under contract to acquire North American businesses representing $300 million in annual revenue — deals it expects to close by early next year. Penske didn’t disclose what the company is buying but said the acquisition is “overweighted” on the commercial truck side of its business, which he said is seeing better pricing than franchised dealership acquisitions.

Penske “has more options than the other public dealers for growth investment,” analyst Michael Ward of Benchmark Co. wrote in a late October investor note rating the stock a buy.

In addition to commercial trucks and its standalone used-vehicle CarShop portfolio, Penske also operates dealerships in the U.K., Germany and Italy, Ward noted.

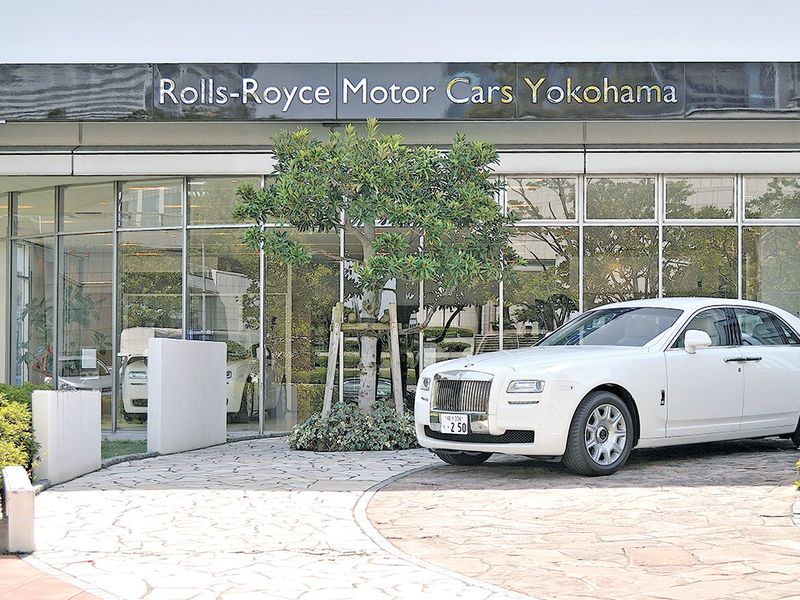

Penske said the final purchase of the Nicole Group — which sells BMW, Mini, Rolls-Royce and Ferrari vehicles in greater Tokyo — will add $250 million in annual revenue. The group also is a distributor for BMW Alpina high-performance vehicle models in Japan.

Penske said his company entered the Japanese market in January 2016 to learn about the dealership business there and the requirements around accounting, controls and risk.

The Japanese retail market is a different animal from the U.S. While there are small entrepreneurs and big family dynasties, the landscape also is populated by powerful retailing networks owned directly by the country’s big manufacturers.

Online retailing barely has a toehold. Total vehicle sales in Japan have hovered at just more than 5 million vehicles a year, vs. more than 14 million in the U.S. during each of the past nine years.

Penske said the acquisition creates a “solid footprint” in the region. He said he has a “very good operator” there who trained for three years before taking over as the group’s CEO, while the group’s former partner and owner is now non-executive chairman.

“We think that we have a lot of opportunity to expand in our market area there with the premium luxury manufacturers,” Penske said. “There’s been a lot of interest.”

Penske told analysts and investors in a call last month that automakers have asked the company “a number of times” to add to its dealership platform in Japan. The company will continue to evaluate U.S. acquisition opportunities that meet brand preferences and help it add scale, he said.

“I think the bigger question is probably human capital, with today having a tough time of hiring people to do the jobs that are needed in the service sector,” Penske said. “And you take on these bigger acquisitions, are you going to be able to have the human capital to operate them at the level that you need to be to maintain the customer satisfaction? And that’s probably tougher than it is to raise the money.”

Hans Greimel contributed to this report.