Toyota Motor North America will look to build “a campus setting” for its planned battery plant to feed North American production of battery-electric and hybrid vehicles, a top executive with the automaker told Automotive News.

That coded language could mean a new assembly plant dedicated to production of skateboard-based battery-electric vehicles is in the offing — instead of just a standalone battery plant. Toyota has no excess capacity in North America; production of the Avalon large sedan in Kentucky will end in 2022.

While a location for a planned investment of $3.4 billion over the next nine years has yet to be announced, Chris Reynolds, chief administrative officer for corporate resources, says he doesn’t expect Toyota to ignite or even respond to a bidding war between states or municipalities that might be eager to attract the plan’s projected initial 1,750 jobs.

“We don’t believe bidding wars to be in Toyota’s benefit,” Reynolds said. “What we really believe in is creating great relationships, and I’m not sure a bidding war leads to that.”

The U.S. investment — part of a previously announced $13.5 billion program globally by parent Toyota Motor Corp. for battery development and production — will include a $1.29 billion lithium ion battery plant, built in partnership with Toyota Tsusho, that will begin producing batteries by 2025. They will go in upcoming localized EVs as well as hybrids.

While not addressing the question directly, Reynolds intimated that a location has already been picked. “Sometime in the near future, we’ll make all this plain, and you’ll have more news to report,” he said last week. The automaker is hosting an event in Southern California next month for journalists to lay out its expanded electrification strategy. Given the aggressive timetable, a decision on location could be announced by the end of the year.

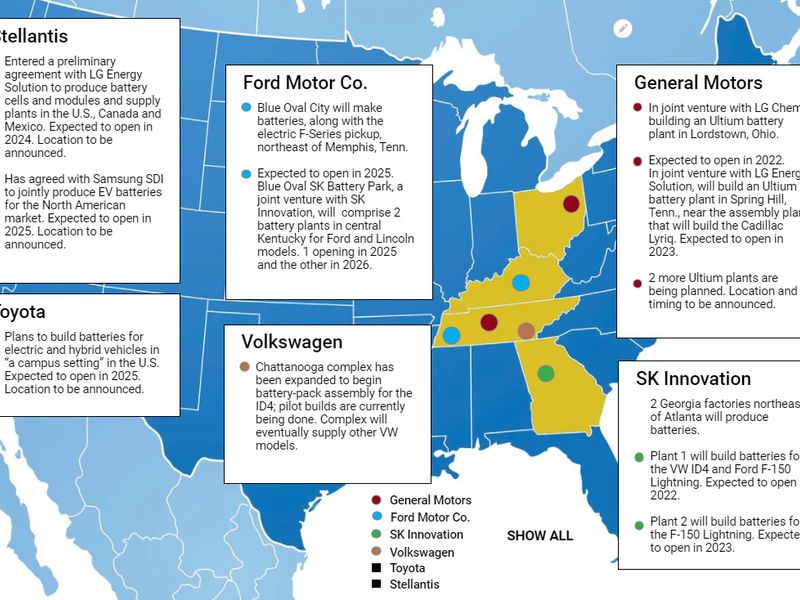

The Japanese automaker’s Oct. 18 announcement mirrors battery strategies revealed previously by domestic automakers Ford Motor Co. and General Motors, as well as EV manufacturing localization strategies by Volkswagen. It also contradicts an earlier pronouncement by Toyota Motor North America executives, who had indicated that the automaker planned to consolidate EV production in Japan, including vehicles to be sold in North America.

Toyota plans to “continue our pattern of what we sell here, we build here,” Reynolds confirmed. Any change, he said, “is not so much in evolution as it is a recognition that with particularly the Biden administration’s support of [charging] infrastructure and the overall emphasis on carbon reduction, that we anticipate our customers are going to want … what we now call alternative-powertrain vehicles, and which by 2030 or so will actually be the norm as we shift” from internal combustion to electrified propulsion.

In April, Toyota introduced the bZ4X, a compact EV crossover concept that it said would go on sale in the U.S. next year. A Lexus version, the LF-Z, is also in the works and due in dealerships in late 2022, as is a similar-sized crossover that Toyota will build for partner Subaru called the Solterra, which also is scheduled to arrive in the second half of 2022.

Toyota, which pioneered hybrid technology in the 1990s with the Prius, has focused on a decarbonization strategy that relies primarily on expanding its stable of hybrids and plug-in hybrids by 2025. In addition, the automaker said it plans to produce 15 EV models globally, including seven Toyota bZ models.