First created to usher in a fully autonomous era of driving, lidar technology is now a cornerstone of the emerging driver-assist market. And lidar companies are drawing the attention of customers — and perhaps equally importantly, investors — as they race to make their systems better and less expensive.

Old stalwarts and newcomers to the field alike are benefiting from the industry’s embrace of lidar sensors for driver-assist systems. The near-term plans for lidar to reach mass production for assist systems should give lidar companies the revenue they need while waiting for the self-driving era that’s still years in the future.

“We’re seeing a lot of these lidars getting down into designs intended for volume production, where they can get a price point at less than $500 per unit in the next few years,” said Sam Abuelsamid, principal research analyst at Guidehouse Insights. “We’re seeing those being adopted in sub- robotaxi applications.”

In March, Honda added its Sensing Elite driver-assist system as an optional package for certain Legend EX hybrid sedans sold only in Japan. It’s a limited rollout, but the system, which contains lidar, is one of the world’s first offerings of Level 3 automation.

Next year, Volvo will begin producing vehicles equipped with Luminar’s lidar and software. And Toyota will soon ship 2022 model Lexus LS 500h vehicles containing its new Teammate system that uses lidar.

But even as lidar proliferates, Abuelsamid and others wonder if there’s enough room for the dozens of competitors vying for contracts. Ouster CEO Angus Pacala believes only three to five lidar companies will remain in five years.

Along similar lines, Eitan Gertel, executive chairman of the Israeli lidar startup Opsys Tech, is skeptical of the revenue projected by many of the lidar companies that have gone public over the past year via special purpose acquisition companies. He suggests the field will winnow in the next 18 months as bold technical projections meet reality.

“People start saying, ‘Hey, you told me this, but you can only do that, and it’s not going to work for me,’ ” he said. “That’s causing changes on the automotive side, because suddenly the plan on paper did not work out as they imagined, and they have to change the plan or look for another source.”

But Gertel and others suggest overall demand remains healthy for use in driver-assist systems. Beyond those uses, lidar are also proliferating in nonautomotive applications, such as warehouses, robotics, security, drones, ports and more. And while robotaxis and other fully autonomous vehicles are deployed in limited numbers, almost entirely for testing purposes today, interest in using lidar in them tomorrow remains brisk.

“You’re going to get economies of scale from ADAS,” says Shauna McIntyre, CEO of Sense Photonics. “On the AV side, you might get some preproduction, but it’s really going to kick in in five years. We’re seeing that AV is not slowing down any time soon. It’s still very strong.”

Here’s an update on key developments at some of the top companies working on developing and producing lidar.

Last week, AEye completed its SPAC merger with CF Finance Acquisition Corp. III, a blank-check company run by Cantor Fitzgerald, and it was listed on the New York Stock exchange under the LIDR symbol.

Global supplier Continental is a key partner for AEye and is integrating its long-range lidar technology into both driver-assist and autonomous-driving systems.

Those are scheduled to enter production in 2024, a year in which AEye projects markets to double from their current size. Samples are now being produced in Ingolstadt, Germany.

AEye has hired a half-dozen senior-level executives over the past six months from competitors, including former Velodyne COO Rick Tewell, former Cepton and Velodyne CFO Bob Brown and former Sense Photonics executive Hod Finkelstein, who is AEye’s chief R&D officer.

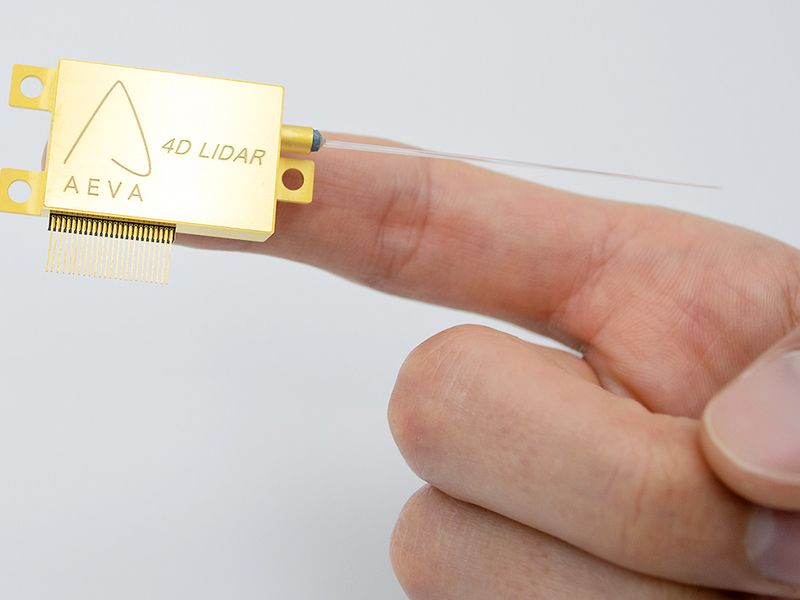

This month, Aeva Technologies Inc. began a strategic collaboration with Nikon Corp. to develop lidar for industrial automation and metrology features. The partnership will focus on using Aeva’s frequency modulated continuous wave lidar for making micron-level measurements.

Nikon’s existing customers for such metrology systems include BMW, Stellantis and aerospace manufacturers, Aeva says.

Aeva went public in March. On the automotive front, the company says its Aeries lidar platform’s resolution has improved to more than 350 points per square degree. It completed its third-generation chip this year, which is scheduled to be ready for series production in 2024. Its long-range lidar can now detect obstacles at beyond 500 meters, Aeva said.

In May, Argo AI, the company that produces self-driving technology for Ford Motor Co. and Volkswagen, finally shed light on its ongoing lidar efforts since acquiring the small New Jersey lidar company Princeton Lightwave four years ago. Argo said it has developed lidar that can detect dark objects at a range of 400 meters. The company hailed it as an industry first, and a key enabler of robotaxi operations in both cities and on highways.

In July, Argo announced a six-city, 1,000-vehicle rollout of ride-hailed AVs in partnership with Ford and Lyft that’s scheduled to take place over the next five years.

Argo calls the key enabler of its lidar “Geiger-mode” sensing, which allows the sensors to detect a single photon of light. It allows the sensing of objects with low reflectivity and is part of a lidar sensor that can achieve long range and high resolution from a single 360-degree sensor.

The company says it is working with a contract manufacturer for series production. The first iterations of the sensor are on Argo’s self-driving test fleet, and volume production plans will be revealed soon, the company said.

After the Palo Alto, Calif., company, valued at $11 billion, acquired Uber’s self-driving division late last year, it moved further ahead in February when it acquired OURS Technology, which will deepen its capabilities to produce lidar at scale.

Aurora has rebranded its lidar systems as FirstLight Lidar. The company is focusing on self-driving trucks as a first application, and partnering with Volvo Group to commercialize autonomous long-hauling with FirstLight as a central component. In March, Aurora said its lidar can detect obstacles at more than 300 meters.

In August, Cepton Technologies Inc. said it would merge with the SPAC Growth Capital Acquisition Corp. in a deal that values the lidar startup at $1.5 billion. The merger is scheduled to close in the fourth quarter.

Days earlier, Cepton said it had reached an agreement with a major global automaker to provide lidar for driver-assist systems, with an expected deployment in vehicles starting in 2023. The announcement came in concert with a $50 million investment from Tokyo-based Koito Manufacturing Co. Ltd.

Separate from its driver-assist design win, Cepton and Ford said in July they have been working together since 2016 on using lidar in R&D work and smart city projects, which have resulted in small-scale deployments.

Count Chinese lidar company Hesai among the sensor industry’s major players. In June, the company raised more than $300 million in its latest investment round, bringing its total funding to date to roughly double that figure.

In July, Hesai formed a partnership with the Chinese robotaxi company WeRide to co-develop automated-driving systems and “vehicle-infrastructure cooperative” systems. Also this year, Hesai added self-driving truck startup Kodiak Robotics a partner.

A long-standing partnership with Bosch is ongoing. Hesai has other projects under way with Chinese robotaxi company AutoX, Baidu, SAIC Motor Co. and delivery-vehicle provider Nuro.

Innoviz says that by the end of 2022, its lidar sensors will allow a major self-driving shuttle company to deploy vehicles at European airports, campuses and in local-transportation efforts. The Israeli company says those developments come via another design win with a major Tier 1 supplier. The deal, announced in May, is Innoviz’s fourth with a Tier 1 supplier and falls in line with CEO Omer Keilaf’s strategy of working directly with suppliers.

In August, Innoviz said it was working in collaboration with a European autonomous-trucking company on an advanced development project, which could result in a multiyear contract once testing is completed.

Innoviz is best known for its ongoing work with BMW, and its lidar is slated to be used on the automaker’s next-generation AVs. Innoviz counts Aptiv and Magna International among its other strategic partners and investors.

Luminar said in July that in its push toward mass production, it has agreed to purchase lidar chip producer OptoGration Inc., and the transaction is scheduled to close in the third quarter. The company is already a key link in Luminar’s supply chain, and the acquisition “deepens Luminar’s competitive moat,” the company wrote in its August 8-K filing.

Series production is set to start in 2022 in support of Volvo Cars, and Luminar’s lidar will be standard on the Swedish automaker’s electric SUVs in driver-assist applications. Luminar also embarked on a partnership with Volvo software subsidiary Zenseact this year, which will be available for sale to other automakers. The system produced by the partnership is designed for highway automation.

Other key customer wins include deals with SAIC, Daimler Truck AG, Intel’s Mobileye and Pony.ai.

In June, Luminar provided a glimpse of a fully autonomous future, unveiling Blade, a lidar system that could integrate across robotaxi fleets, trucks and passenger vehicles.

“While some AV companies focus on trucks or robotaxis, our focus is building the technology foundation for autonomy across all types of vehicles,” Luminar CEO Austin Russell said.

The Intel subsidiary may be best known for its camera-based driver-assist systems. When it comes to lidar, Mobileye inked a contract with Luminar in November 2020 to use lidar in driver-assist features after co-developing sensors together for the past two years.

Just weeks later, Mobileye said it was crafting its own lidar system on chip for use in vehicles starting in 2025. By using its own chips, Mobileye expects to cut costs for self-driving systems for personally owned vehicles. Mobileye believes a bill of material cost of $3,500 is possible for such a system.

“The fact we can put it on a chip makes the cost relatively reasonable,” Mobileye CEO Amnon Shashua said at the time. “If we didn’t have this technology, to put it on a chip, the cost would basically kill it.”

Opsys Tech uses vertical cavity surface emitting lasers and single photon avalanche diode receivers in a proprietary solid-state lidar technology. With more than a half-dozen lidar companies going public, it would be logical to assume Opsys Tech might join that list. But Executive Chairman Gertel says that’s not the case.

“After running a public company for over 15 years, the last thing you want to do is stand in front of investors and say, ‘My revenue is going to be X in five years,’ ” he said. “When we’re ready, we’ll go public. Not ahead of time.”

The company is validating and testing its sensors now, and Gertel says they can spot obstacles at 300 meters without corresponding loss of reflectivity or resolution. New test results will be released in the first quarter of 2022.

Meanwhile, Gertel says, the company has reached contractual agreements with several partners, including at least one Tier 1 supplier, though they have not been named publicly. Along similar lines, Opsys Tech has manufacturing partnerships set in Asia, where Gertel says lidar will first reach the road in large quantities.

He said that projected demand is “very healthy” from customers, adding: “They are all getting ready and accelerating their interest and efforts to integrate lidar into their platforms.”

Perhaps more than any other lidar company, Ouster has sought to capitalize on the possibility of deploying lidar in applications beyond automotive. The company says it has more than 600 customers in markets such as smart infrastructure, robotics, industrial and transportation.

This year, Ouster reached an agreement with automated-truck developer Plus to provide 2,000 units for its big rigs. It was the largest order Ouster has received from a self-driving truck company. There’s a chance that it will be the first of more work between the two companies, as Plus has partnered with Amazon to deploy automated trucks.

Ouster also is providing its short-range lidar for May Mobility’s shuttles.

In its second-quarter results, Ouster reported shipping more than 1,460 lidar sensors, a 49 percent increase over the first quarter. Its $7.4 million in revenue grew 11 percent during the same time period.

Sense Photonics is concentrating on driving down the cost of lidar sensors, and the Bay Area company is doing that by driving up the number of points per second it can capture. The company claims it can capture more than 10 million points per second compared with the approximate 2 million found in traditional systems. This allows Sense Photonics to not only detect objects faster, but also classify them.

In June, the company unveiled a flash-lidar system called MultiRange which offers high-resolution, long-range capability along with midrange capability with a wider field of view — all from a single shot from a lone sensor.

Also in June, Sense Photonics announced a development deal with a “major” (but still unnamed) Detroit automaker that will pave the way toward a passenger-car production program. CEO McIntyre says the company’s solid-state flash technology will make manufacturing lidar at scale an easier proposition.

“When I looked at the competitive field, I realized they’re many really complicated mechanical products,” said McIntyre, a former Google and Ford executive who joined the lidar startup in April 2020. “I knew that anything that’s going to scale in high volume has to be solid state, and streamlined as possible.”

Valeo holds the distinction of producing the first lidar sensor ever deployed in a mass-market automobile. In 2017, the company’s first-generation “SCALA” lidar enabled driver-assist features in Audi’s A8 sedan, which underpinned the industry’s first deployed, albeit not activated, Level 3 automated system. The French supplier says more than 100,000 of the sensors, based on technology from fellow lidar maker Ibeo, have reached the road. Honda used the first-gen SCALA in some models of its new Legend EX sedan in Japan. Each system uses five of the sensors.

Separately, Valeo says its second-generation SCALA sensor is in ramp-up phase. The company will start mass production in October and the sensor will be utilized in a Level 3 automated system with a single forward-facing lidar.

Velodyne pioneered lidar for automotive purposes, but the company has been beset by seismic internal discord.

CEO Anand Gopalan departed in late July after only 19 months. In his place, the company has appointed multiple senior executives to an “Office of the Chief Executive,” though it’s not clear whether that arrangement is permanent.

Gopalan’s departure came only months after Velodyne’s board ousted company founder David Hall. His wife, Marta, remains on the board, though both Halls have been accused by the board of “inappropriate behavior.” In a written statement, David Hall said a “boardroom ambush” had occurred, and that he would soon be “righting these wrongs.”

Separately, auto industry veteran Kristin Slanina was appointed to Velodyne’s board in August. This year, the company also added former National Transportation Safety Board Chair Deborah Hersman to its board.

In February, Ford sold its stake in Velodyne as the automaker and Argo AI chose to use their own in-house lidar sensors. In August, Velodyne affirmed its revenue guidance of between $77 million and $94 million for 2021.

Waymo started the trend among AV developers to craft its own lidar in house. Waymo relied on its “Laser Bear Honeycomb” design, which offers up to a 95-degree vertical field of view.

Beyond its use in Waymo fleets now operating commercially in metro Phoenix, the company says it is licensing its technology to companies working in nonautomotive sectors, such as warehousing, agricultural, industrial, mapping and smart city sectors.