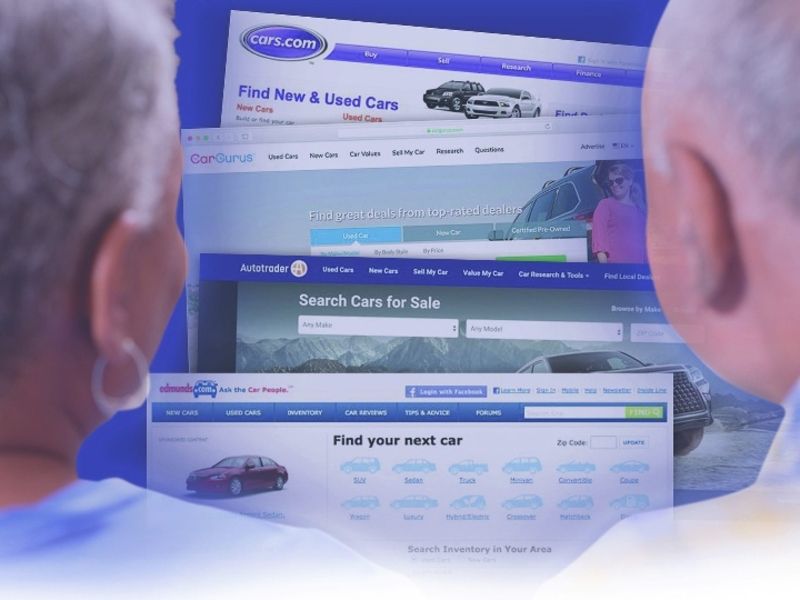

Companies that provide Internet vehicle listings are looking beyond generating traditional leads to help consumers transact online.

The capabilities that listings sites such as CarGurus and TrueCar are adding to their platforms expand on their original auto classifieds businesses. They range from integrating with digital retailing software providers to allowing consumers to build deals that incorporate vehicle financing and protection products.

The shift follows a broader industry trend toward e-commerce that had been slow to evolve until the coronavirus pandemic sped it forward. Executives of the listings companies and observers of the segment say allowing consumers to complete more purchase steps on third-party websites before passing them on to a dealership will generate deeper leads from more-serious buyers.

Someone who acts beyond simply requesting a quote, such as seeking a trade-in value or applying for credit, signals to a dealership that “this is a hot prospect,” said Dennis Bulgarelli, vice president for automotive at Comscore, which provides market intelligence data.

In April, CarGurus, of Cambridge, Mass., said it was offering dealerships early access to its new CarGurus Convert digital retailing product. The company says the tool allows shoppers to calculate their vehicle trade-in, taxes and fees; get pre-qualified for financing through partner lenders; and choose from a dealership’s finance-and-insurance products.

The following month, Santa Monica, Calif.-based TrueCar announced a pilot integration with digital retailing provider Roadster that allows consumers to move between TrueCar’s website and Roadster’s Express Storefront tool at about 650 dealerships working with both companies. That was before dealership management system giant CDK Global Inc. acquired Roadster in a $360 million cash deal; TrueCar says the acquisition did not affect its work with Roadster.

Chicago-based Cars.com said its Dealer Inspire unit — which offers dealership websites, chat tools and other technology — is growing at a faster rate than its larger marketplace business. The company plans to add features to its Online Shopper digital retailing product, including credit approvals, CEO Alex Vetter said in May. Its ultimate goal, he said, is to move shoppers on its marketplace directly into dealerships’ systems.

Edmunds jointly developed an instant appraisal-and-offer tool with used-vehicle retailer CarMax, which bought Edmunds in the spring in a deal valued at $404 million. Nick Gorton, Edmunds’ chief innovation officer, said the partnership eventually could unlock more capabilities.

Meanwhile, Autotrader, part of Cox Automotive, in May introduced My Wallet, a feature that generates personalized payment information. That follows an update last year to its Accelerate My Deal digital retailing product that allows shoppers to customize a purchase while searching for a vehicle on its website.

“As I think about the evolution of leads over the last 10 to 20 years, it’s changed drastically,” said Erin Lomax, vice president of operations at Autotrader.

Today, “you’re not just getting the consumer’s name, email, phone number and what car they’re looking at,” Lomax said. “You’re getting their credit range, their trade-in value, the amount they want to put down on their car. So dealers are able to work these leads much more effectively and understand the consumer in a better way than ever before.”

CarGurus’ goal with its Convert product is to make a customer’s vehicle purchase faster and more convenient, Tom Caputo, the company’s chief product officer, said in an April interview. The tool is intended to be flexible enough to work with customers who want to do a few or many steps online before connecting with a dealership.

“We always have to be paying attention to where our customers are and what our customers are asking for,” Caputo said. “Dealers are recognizing this is where the market is moving. So I think it is certainly incumbent upon CarGurus and others in the space to make sure that we are paying attention to those trends.”

TrueCar said it plans to build on the Roadster partnership by integrating with more digital retailing vendors.

The company also is building its own in-house digital retailing product, with the goal of completing it by the end of this year, CEO Mike Darrow said in May. That could be an option for TrueCar client dealerships that don’t have their own digital retailing provider, he said.

“There will always be listings, but I think for quite some time now — several years — it’s been a relatively stagnant business,” said Marvin Fong, an equity analyst with BTIG who covers some of the public marketplace companies.

“I do believe it’s a natural evolution,” Fong said. “People are so much more comfortable doing more [online].”