LOS ANGELES — Hyundai Motor America is rolling out data tools that allow customers to share information on their driving usage and driving habits with insurance companies, potentially lowering premiums.

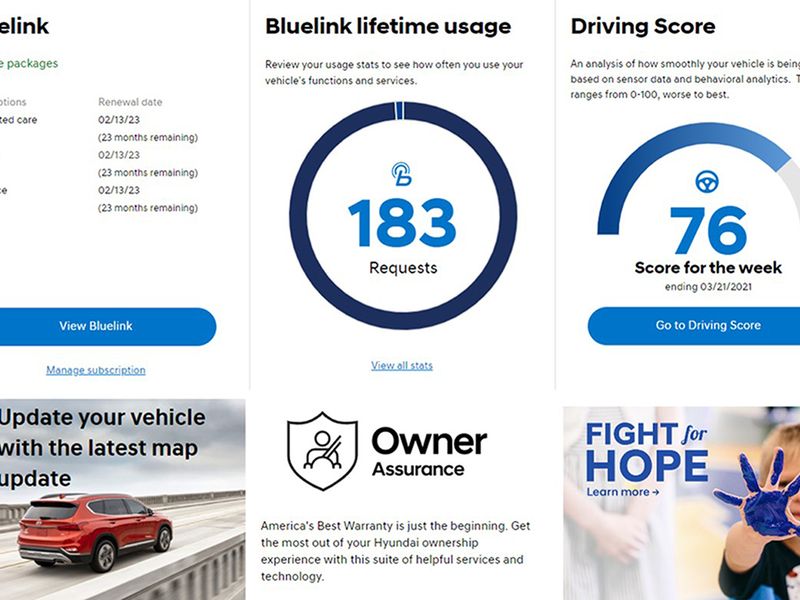

The usage-based insurance program relies on travel-time data and driving-behavior data using vehicle sensors and Hyundai’s Blue Link telematics, the automaker said in a news release. The information is processed by global data analytic provider Verisk to generate a personalized driving score.

“Verisk has developed these insights through an extensive examination of key driving characteristics that have a proven correlation with insurance losses, including smooth driving, speed responsibility, driving time of day, consistent driving and time behind the wheel,” Hyundai said.

Hyundai owners can also improve their scores, based on a 0 to 100 scale, through tips provided on the myHyundai.com website. For example, a driver could better their score by braking smoothly, accelerating gently and making fewer late-night trips, the company said.

“As demand for more transparent auto insurance pricing grows, usage-based insurance is a powerful way for Hyundai drivers to have greater control over their insurance costs,” said Manish Mehrotra, executive director of digital business planning and connected operations at Hyundai Motor North America.

Hyundai said usage-based insurance could potentially save consumers hundreds of dollars a year through safe-driver discounts.

As part of the program, Hyundai drivers consent to provide their driving information to the Verisk Data Exchange, which in turn makes it available to insurance providers. Three of the 10 largest insurance carriers are connected to the data-exchange service, the automaker said.

Hyundai’s Blue Link connected-car services are complimentary for the first three years. The driving score is accessible to users without sharing the data with third-party sources. Drivers who agree to share the information with insurance providers can opt out at any time, Hyundai said.