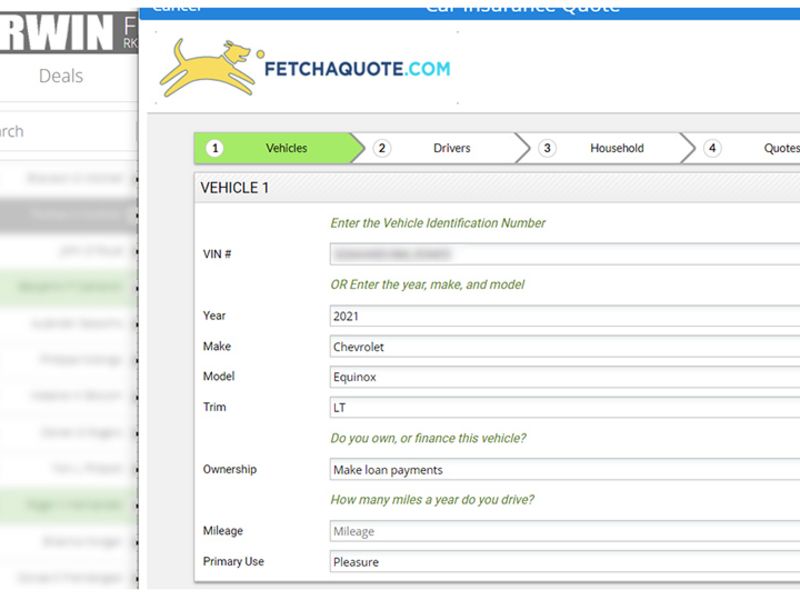

Darwin Automotive’s finance platform has integrated with Fetch, an electronic auto insurance comparison and purchase platform. The online marketplace allows auto customers to search for and compare insurance rates as part of an in-store or digital retailing process.

The integration is the latest example in a growing trend of U.S. dealerships incorporating auto insurance into their offerings in the hopes of helping customers cut costs associated with vehicle ownership.

RK Auto Group in Virginia Beach, Va., went live with the Fetch integration in February. The program will continue rolling out, state by state, across Darwin’s footprint, CEO Phil Battista told Automotive News. Dealerships can opt in to the auto insurance add-on at no additional cost, he said.

Fetch generates a limited number of offers to streamline the process and keep shoppers from getting bogged down at the insurance stage. The platform allows customers to purchase insurance instantly without speaking to an agent, he said.

“We chose Fetch because one of the things we don’t want to do is elongate the F&I process,” Battista said. “It’s 100 percent automated.”

Fetch was founded in 2014 by a franchised car dealer and is focused on ensuring customers have insurance at the point of sale. The private company has worked with “hundreds” of dealerships, according to CEO Fred Rector.

Rector said the company does not sell leads or offer advertising on the site.

“We want to make sure we complement the car deal, not compete with the car deal,” he said.

Darwin Automotive, of Iselin, N.J., operates nationally with more than 8,500 dealerships subscribed to its programs. The company is on track to deliver 8.5 million units on the platform for the year, it said in a statement. Its clients include Holman Automotive Group, Leith Automotive Group, Herb Chambers Cos. and Sonic Automotive.

Incorporating auto insurance options into a dealership’s retailing software benefits dealerships in several ways, Battista said. It allows customers who want to drive off in their new vehicle to obtain the proof of insurance required, and incorporates a new profit center for dealership finance departments.

If a customer selects auto insurance through the Fetch portal, the dealership is paid a fee by Fetch. The fee will be dependent upon compliance requirements of the individual state, Rector said.